Sumitomo Mitsui Trust Bank, Limited plays a central role in the Sumitomo Mitsui Trust Group as a specialized institution that handles banking and trust operations in an integrated manner. The company operates a wide range of businesses, targeting retail and corporate clients, asset management, as well as real estate.

In recent years, the company has been actively engaged in digital transformation (DX), with the utilization of digital technology and development of digital human resources as major pillars of its mid-term plan. Masahiro Nagao explains the company’s DX direction, saying, “We are accelerating our digital strategy with four pillars: ‘Challenge new technologies,’ ‘Advancement and expansion of data science,’ ‘Advancement of business infrastructure’ and ‘Reskilling human resources.’”

One of these initiatives involves using AI to provide services to individual customers. Target clients are the elderly, who pass on assets and businesses to their families, such as inheritances and trusts. In addition, in recent years, the company has developed digital channels such as smartphone applications and has focused on targeting the “asset building demographic” who intend to create assets for the future in their 30s to 50s. The goal is to provide comprehensive financial solutions through consulting services for all generations, from middle to senior.

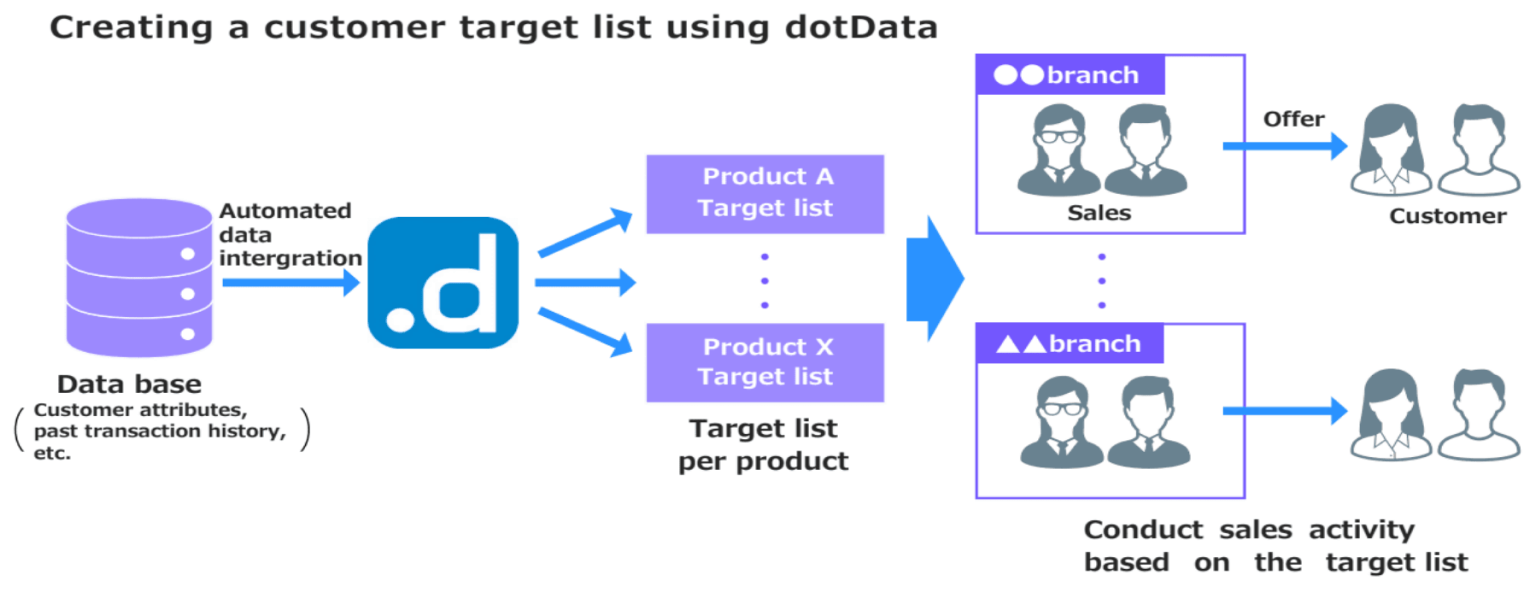

Mr. Keisuke Kondo says that AI has been used early on to support sales activities of such products for individual customers.

“In the past, we used to create a target list based on experience, focusing on customers who had time deposits that had not yet matured and customers who had investment products. However, as customer needs and attributes change and the pace of change accelerates, the company needed to improve the accuracy of targeting to provide total solutions that accurately responded to diversifying customer needs. One way to do that is to use AI.” says Mr. Kondo.