Banks need to manage risk – constant pressure from competitors, growing governance and regulatory requirements, increasing costs, fraud or customer defaults. AI/ML enables you to discover hidden risk factors and patterns from a massive amount of data, allowing you to control risk faster and more dynamically.

dotData Transforms Banking

with AI Automation

In the new world of increased competitiveness from both traditional channels and FinTech, AI Automation can help banks stay in the lead.

AI-Driven Banking

How AI Changes Banking

Whether it is consumer, commercial, or investment banking, your bank must know your clients’ unique needs and offer tailored solutions. Predict default risk, detect transaction fraud, prevent payment failure, and decrease customer churn by leveraging AI automation from dotData.

Consumer Banking

dotData helps banks create detailed customer profiles by combining demographic data with transaction histories, including deposits, withdrawals, and credit card payments. This enables highly targeted marketing through direct mail and digital channels, enhancing upselling and cross-selling opportunities. With dotData’s features, banks can also generate personalized product recommendations and marketing creatives based on deep customer insights, improving customer satisfaction and sales across all products and services, including personal loans and investment products. This data-driven approach boosts both sales traction and customer lifetime value.

Commercial Banking

dotData empowers banks to build predictive models that anticipate the unique needs of business customers based on industry, size, and other demographic factors. By analyzing historical data, dotData helps banks create highly tailored products and services that align with predictive patterns. This allows for the development of more efficient forecast models specifically designed for B2B offerings, improving conversion rates by catering to the unique needs of each client. Ultimately, dotData strengthens customer relationships by enabling banks to offer personalized solutions and identify client needs more accurately through detailed profiles and historical insights.

Credit Monitoring & Risk Management

AI and data analytics are transforming credit and risk assessment in financial institutions, making credit decisions faster and more accurate while reducing risk and improving business efficiency. dotData allows banks to build predictive models that analyze data such as delinquency patterns, credit downgrades, and demographic information to quickly identify at-risk clients. By combining these insights with transaction and payment patterns, banks can establish clear risk assessment criteria and better manage operational and market risks, optimizing their overall risk portfolios for sustainable growth.

Cash & ATM Management

dotData helps banks forecast cash demand for their ATM locations by analyzing historical demand data, location-specific information, calendar events, and high-impact occurrences like paydays. By building predictive models that estimate daily cash needs on a month-to-month basis, dotData allows banks to optimize operational efficiency, ensuring ATMs are adequately funded while minimizing excess capital allocation. This proactive approach reduces the risk of ATM shutdowns due to cash shortages and lowers operating costs by aligning cash reserves with actual demand, accounting for seasonality and other influencing factors.

Forecast Financial Product Demand with ML & AI

dotData enables banks to optimize their product portfolios by leveraging historical sales data and customer demographics to build predictive models of future product demand. This allows banks to better understand which products are needed, when they are needed, and which markets should be prioritized. By forecasting interest rate changes, product demand, loan preferences, and cash-flow requirements at both branch and organizational levels, dotData helps banks make more informed decisions, ensuring they meet customer needs while optimizing overall business performance.

Employee Performance Analysis

dotData enables organizations to build KPI-driven predictive models of employee performance by leveraging basic employee attributes and historical data from aptitude tests, attendance, performance evaluations, and training history. By analyzing this data, dotData helps identify the characteristics of high-performing employees as well as those at risk of underperformance or attrition. These models can be tailored to specific employee types and aligned with ongoing performance metrics. As a result, organizations can enhance employee performance by focusing on key performance indicators, improving morale, and reducing attrition by addressing patterns that may lead to employee exits.

CRM

In a bank’s CRM strategy, strengthening digital touchpoints alongside traditional face-to-face services is essential. By analyzing data from CRM systems, online behavior, transaction history, and digital interactions, AI enables personalized customer engagement. It predicts product interest, identifies upselling and cross-selling opportunities, and detects early signs of cancellation to improve retention. Additionally, AI analyzes customer feedback on digital channels, providing insights for service improvements, ultimately enhancing customer relationships across all touchpoints.

What Our Customers Say

Exeter Finance

The biggest problem is that, when doing it manually, it’s just a repetitive, trial-and-error process that takes time. dotData solves a problem I’ve been trying to solve for 20 years.

sticky.io

I was spending 95% of my time wrangling data…now I can offload most of that work and just focus on delivering viable patterns and insights.

Use Cases

Sumitomo Mitsui Trust Bank

A Multinational Industrial Supplier

News

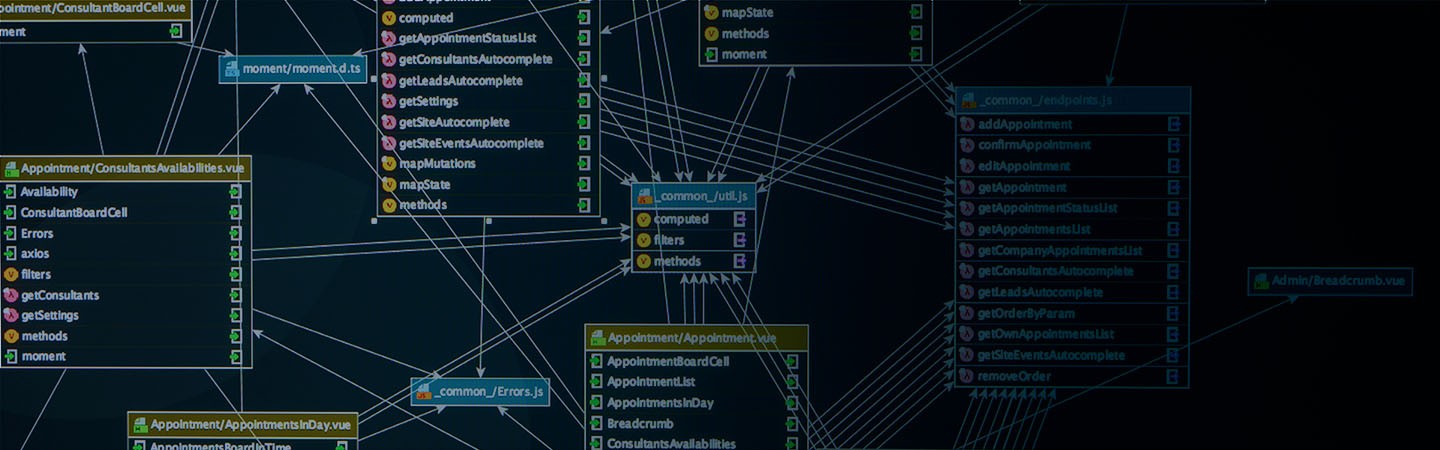

dotData's AI Platform Maximize Data Utilization through Feature Discovery

dotData leverages automated feature engineering to build models using machine learning, enhancing data by accumulating feature values as assets and extracting valuable insights, enabling businesses to become more data-driven. Our platform satisfies a wide range of needs, including business transformation, and support the effective use of data and AI to drive innovation and growth.

Request a Demo

We offer support tailored to your needs, whether you want to see a demo or learn more about use cases.