Beyond FICO: Five Critical Signals Your Credit Risk Assessment Model Is Missing

- Industry Use Cases

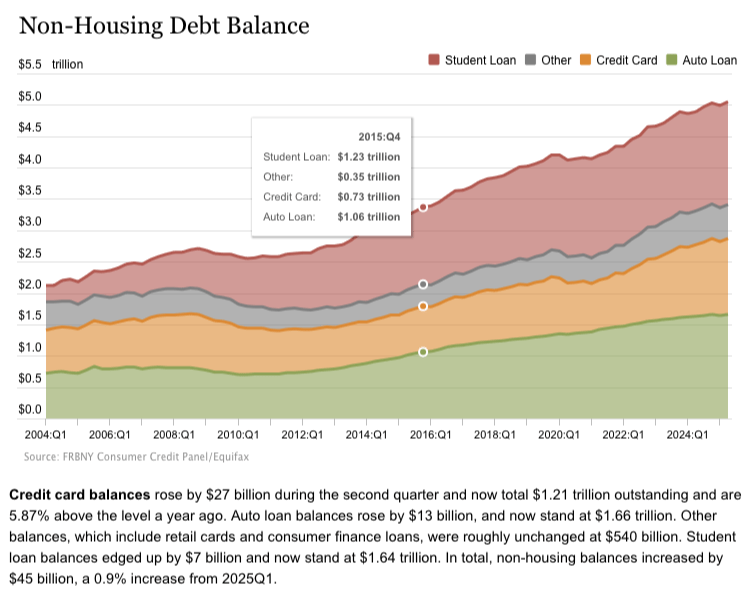

The lending landscape is experiencing significant turbulence, and the need for change is becoming increasingly paramount. Following a period of relative economic calm, unprecedented household debt and rising delinquencies are cause for concern. The most visible sign of this shift in credit risk domain is the growth in household debt. According to the Federal Reserve Bank of New York’s Center for Microeconomic Data, total household debt in the United States has surged to an unprecedented $18.39 trillion as of the second quarter of 2025. It represents a significant increase in leverage for the average American household, straining household budgets in an environment of persistent inflation and elevated interest rates.

More concerning than the debt itself is the upward trend in delinquencies. The flow of household debt into serious delinquency (defined as 90 days or more past due) is increasing across multiple loan categories. Mortgage delinquencies, although still low by historical standards, are trending upward, with the transition rate into serious delinquency rising from 0.95% to 1.29% year-over-year. Auto loan and credit card delinquencies are also showing signs of stress, normalizing from what the Office of the Comptroller of the Currency (OCC) describes as “atypical historically low levels” to a new, higher-risk equilibrium.

This trend is creating a dangerous false sense of security in credit risk assessment. While the overall banking sector may appear sound, the data reveal an evident deterioration in consumer credit health. The problem is rooted in a pandemic-era distortion: stimulus and forbearance programs led to an upward shift in credit scores, resulting in millions of borrowers seeing their FICO scores improve without a corresponding change in their financial status. Now that economic support has ended, some of these same “safe,” high-scoring borrowers are beginning to default.

This new reality invalidates a core assumption of legacy underwriting: that a high credit score is a reliable proxy for low credit risk. Lenders now face greater uncertainty, as they rely on an instrument that is no longer calibrated to current economic conditions.

For decades, the FICO score’s five-factor model — payment history, amounts owed, length of credit history, new credit, and credit mix — has been the bedrock of consumer lending. Yet, this foundation is now showing cracks. The world has changed, but the logic behind credit scores remains unchanged. Its biggest flaw is its reliance on the past to predict the future; it is a lagging indicator that struggles in an era of rapid economic change.

Furthermore, this reliance on historical data creates blind spots. An estimated 26 to 49 million Americans are considered “credit invisible” or have a “thin file,” making them unscorable by any traditional credit risk assessment model. These individuals are not inherently high-risk; they are often young adults, recent immigrants, or those who purposely avoid conventional credit products. By being unable to see financial responsibility demonstrated through alternative means, like on-time rent and utility payments, lenders are turning away millions of potentially profitable customers.

The nature of work and finance has also changed, and lenders must understand these shifts in risk factors. The rise of the gig economy means millions have variable income streams not built into legacy models. The explosion of Buy Now, Pay Later (BNPL) services has introduced a new form of ‘invisible debt,’ as consumers can become significantly over-leveraged without that debt appearing on their credit file. By adapting to these changes, lenders can ensure a more comprehensive underwriting strategy.

The FICO has become a measure of a consumer’s participation in a specific financial system. When lenders and financial institutions rely on this single, backward-looking score in credit risk analysis, it is not just a missed opportunity, but a significant and growing threat to portfolio stability. The future of resilient underwriting demands a shift toward discovering the deeper, behavioral signals hidden within the vast historical data that lenders already possess.

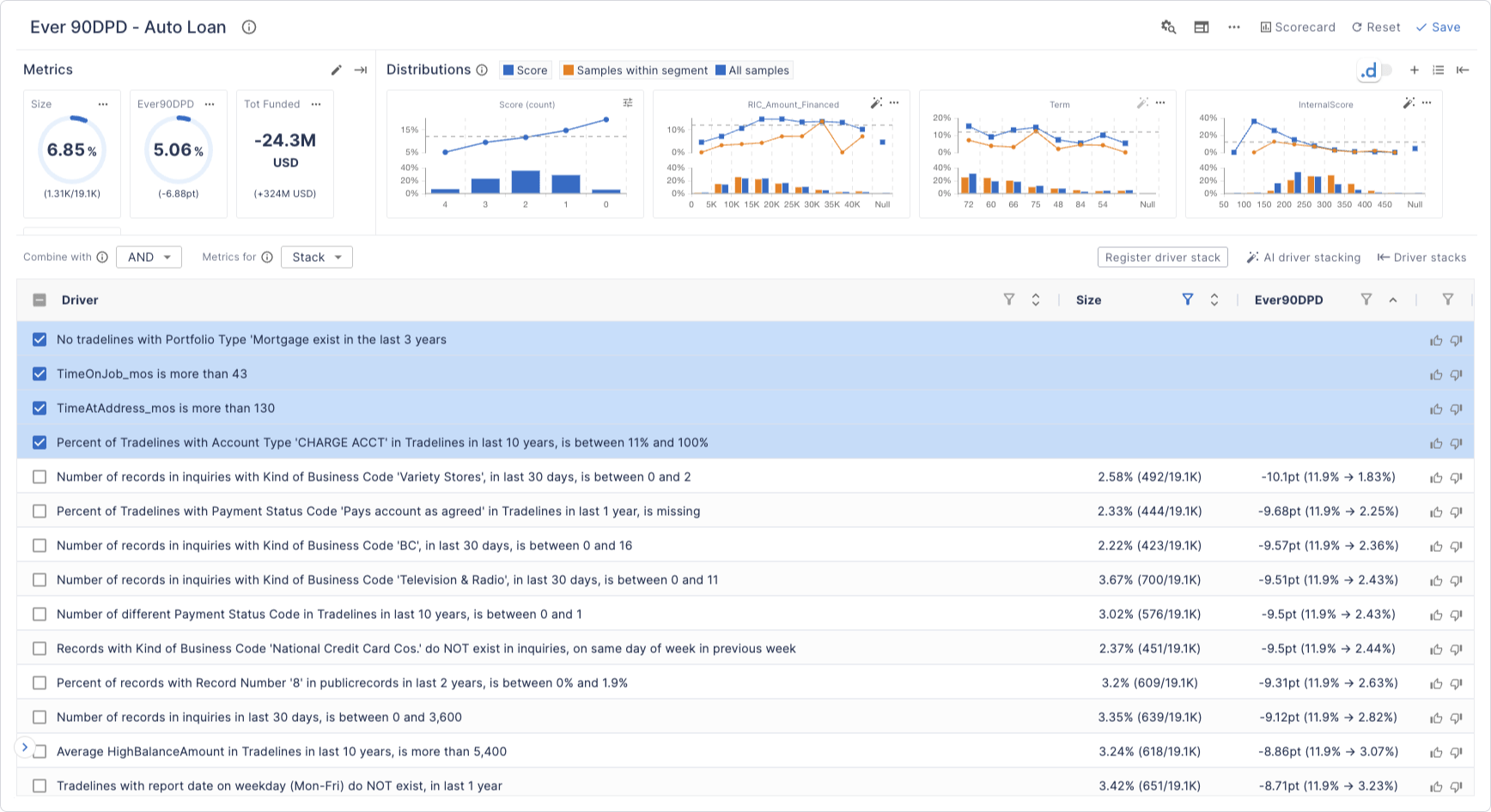

With the primary objective of building a truly resilient underwriting strategy, lenders must look beyond the single, static FICO score and decode the rich, dynamic signals hidden within all their data. These signals are complex patterns of behavior that tell a much deeper story about a borrower’s financial health, stability, and psychology. Uncovering them requires moving from static analysis to dynamic, multi-dimensional feature discovery. Here are five categories of hidden risk signals that most traditional underwriting models are missing:

Traditional income verification, relying on a paystub or W-2, provides a static snapshot. Real-time cash flow underwriting, utilizing consumer-permissioned access to bank transaction data, provides the complete picture. It reveals not just the amount of income, but the velocity and volatility of money, offering a far more predictive view. FICO’s research indicates that transaction data analytics can identify signs of financial distress up to 40 days before a customer becoming delinquent. Key credit risk patterns include income volatility, sudden shifts in spending habits (e.g., an increase in spending at discount retailers), and deteriorating balance health (e.g., frequent overdrafts).

The two-year, stable W-2 employment history is rapidly becoming obsolete in a labor market where gig, freelance, and contract workers could soon represent half the workforce. Even for traditionally employed borrowers, a job change can create temporary cash flow gaps and expose them to a window of vulnerability. The key is to move beyond the form of employment status to the substance of income, which is now possible through real-time, consumer-permissioned access to payroll data. This technology allows lenders to instantly verify multiple income streams, pay frequency, and historical earnings, providing a far richer picture of a borrower’s capacity to repay.

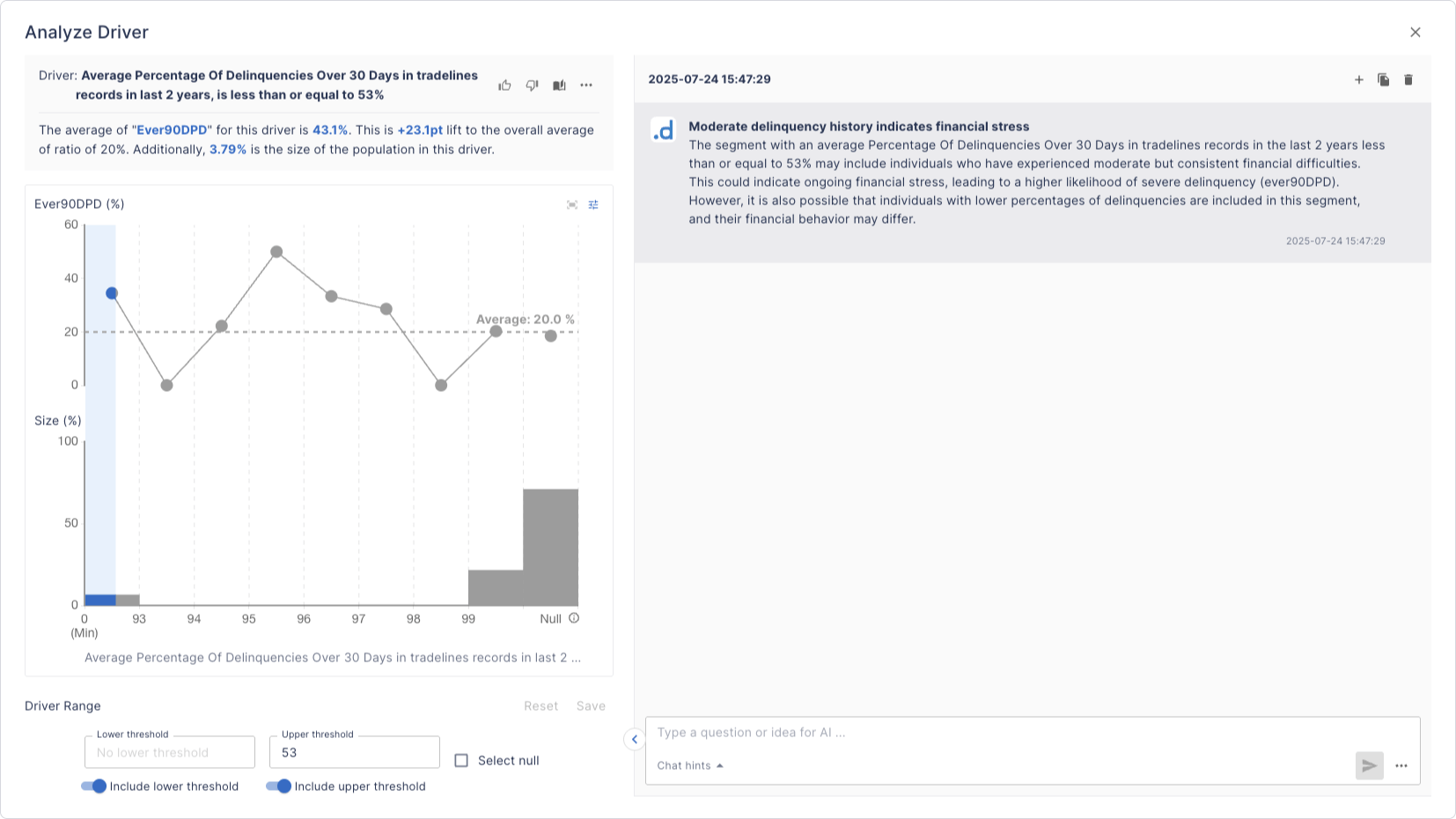

The credit utilization ratio is a heavily weighted factor in a FICO score, but viewing it as a static number can be a mistake in credit risk management. The real predictive power lies in understanding the behavioral patterns that lead to high utilization, which can be decoded by analyzing historical credit bureau tradeline data. As a borrower’s financial situation deteriorates, they often actively increase their draw on available credit lines in a “race to default,” tapping every available dollar before the lender cuts off access. The consumer pattern means that monitoring the rate of change in utilization is a far more powerful leading indicator of risk than the static percentage. Other red flags include a shift from paying balances in full to carrying a balance and a pattern of making only minimum payments.

Some of the most predictive data in a consumer’s financial life is absent from their traditional credit file. A long history of on-time rental payments is a powerful signal of creditworthiness, yet fewer than 5% of tenants have this information on their credit reports. Incorporating this data can significantly improve credit risk assessment, especially for “credit invisible” consumers. Similarly, a positive history of utility payments is rarely reported but is highly predictive of financial discipline. Finally, the rise of Buy Now, Pay Later (BNPL) has created “invisible debt,” as a consumer can accumulate significant debt obligations across multiple providers without it being visible on a traditional credit check, a behavior known as “loan stacking.”

The consumer loan application process itself has become a rich source of behavioral data. Every click, keystroke, and moment of hesitation leaves a trail of metadata that can reveal powerful signals about a borrower’s intent, confidence, and even potential for fraud. Traditional internal models ignore this data, but modern approaches recognize that how an applicant fills out the form can be as predictive as the information they provide. Example red flags include repeatedly editing stated income, using a VPN or proxy service to obscure location, or using a disposable email domain.

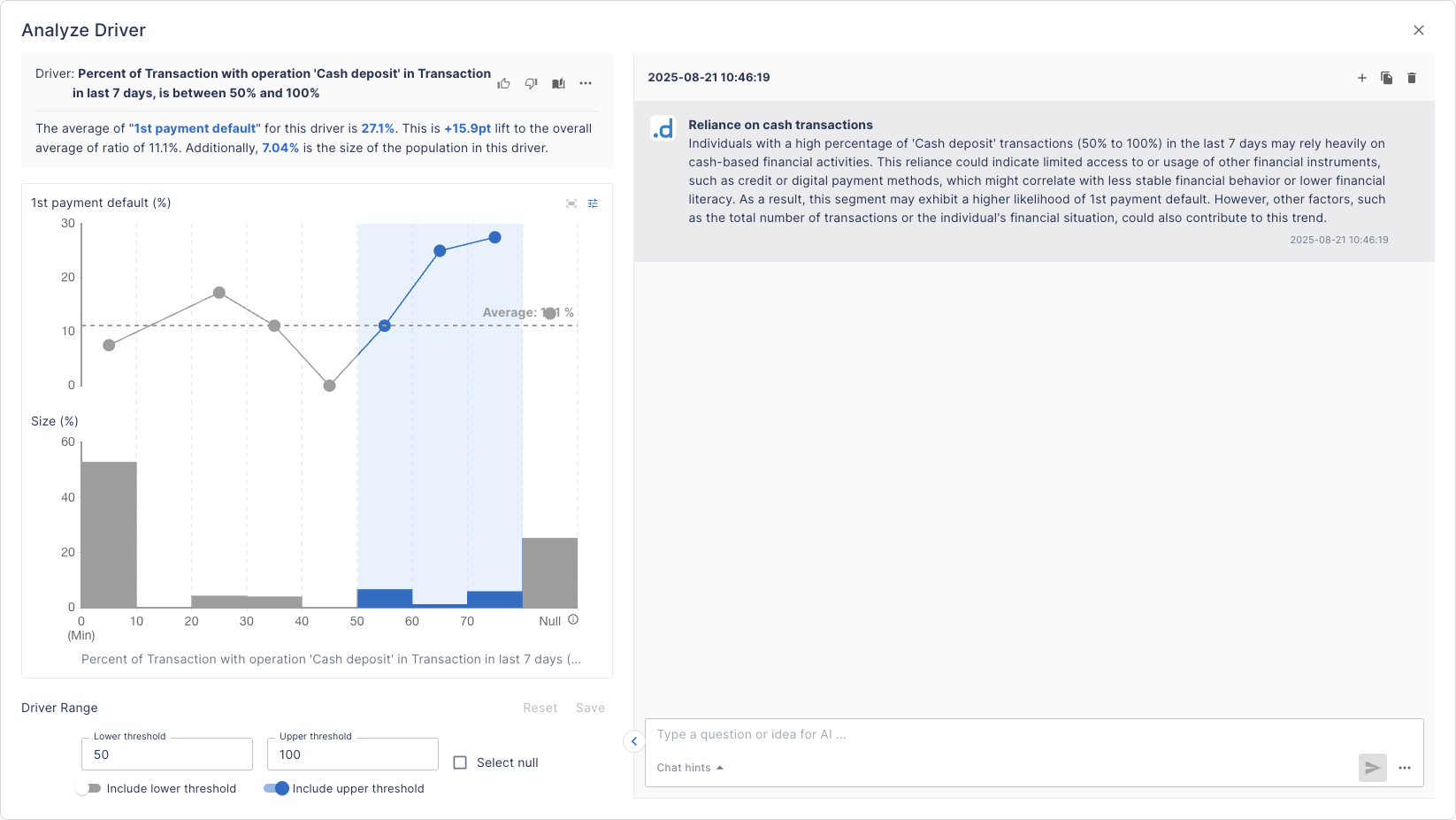

Recognizing these hidden signals is only the first step. The true challenge lies in systematically uncovering them from massive, complex datasets. The risk signals that matter most are not simple variables. Risk signals are complex patterns emerging from the interaction of data across credit bureau tradelines, bank transaction feeds, payroll data, and application logs. A data science or analytics team using a traditional credit risk modelling approach faces a complex task. To find a feature like the “Debt Spiral Indicator,” an analyst would need to hypothesize its existence in advance and then write complex queries to test for the hypothesis. Given the trillions of possible variable combinations, the vast majority of these valuable signals will remain unknown and undiscovered.

The sheer volume of data and patterns available makes machine learning and AI-powered automated feature discovery an essential tool. Tools like dotData’s Feature Factory augment and amplify the capabilities of data science teams, automating the most time-consuming part of the model-building process: feature discovery.

This new paradigm frees data science teams from the manual drudgery of data preparation, enabling them to focus on higher-value strategic tasks, such as model validation, deployment, and business interpretation.

Relying solely on a single, backward-looking credit score is limiting. The economic shifts of the post-pandemic world have exposed the limitations of legacy models. The rising tide of delinquencies, particularly among borrowers once considered “safe,” is an urgent call for a new approach. A wealth of predictive information lies dormant within the data that lenders already possess. The lenders who thrive will be those who embrace this complexity and invest in the technology required to master it.

In an era defined by uncertainty, the ability to see what others cannot is the ultimate competitive advantage. Lenders who have the vision to transition to a richer, data-driven process that uncovers the significant signals hidden within both bureau and non-bureau data will be able to create a competitive moat. This not only helps them to achieve higher accuracy in a credit risk assessment model but also plays a pivotal role in separating them from lenders still stuck on legacy processes.