In the highly competitive landscape of non-life insurance companies in Japan, Mitsui Sumitomo Insurance (MSI) stands out as a key player within the MS&AD Insurance Group, boasting the largest market share in the non-life insurance sector. With a wide network of offices throughout Japan and a growing global presence in 42 countries, MSI is committed to driving digital transformation (DX) and leading the industry by embracing cutting-edge technologies.

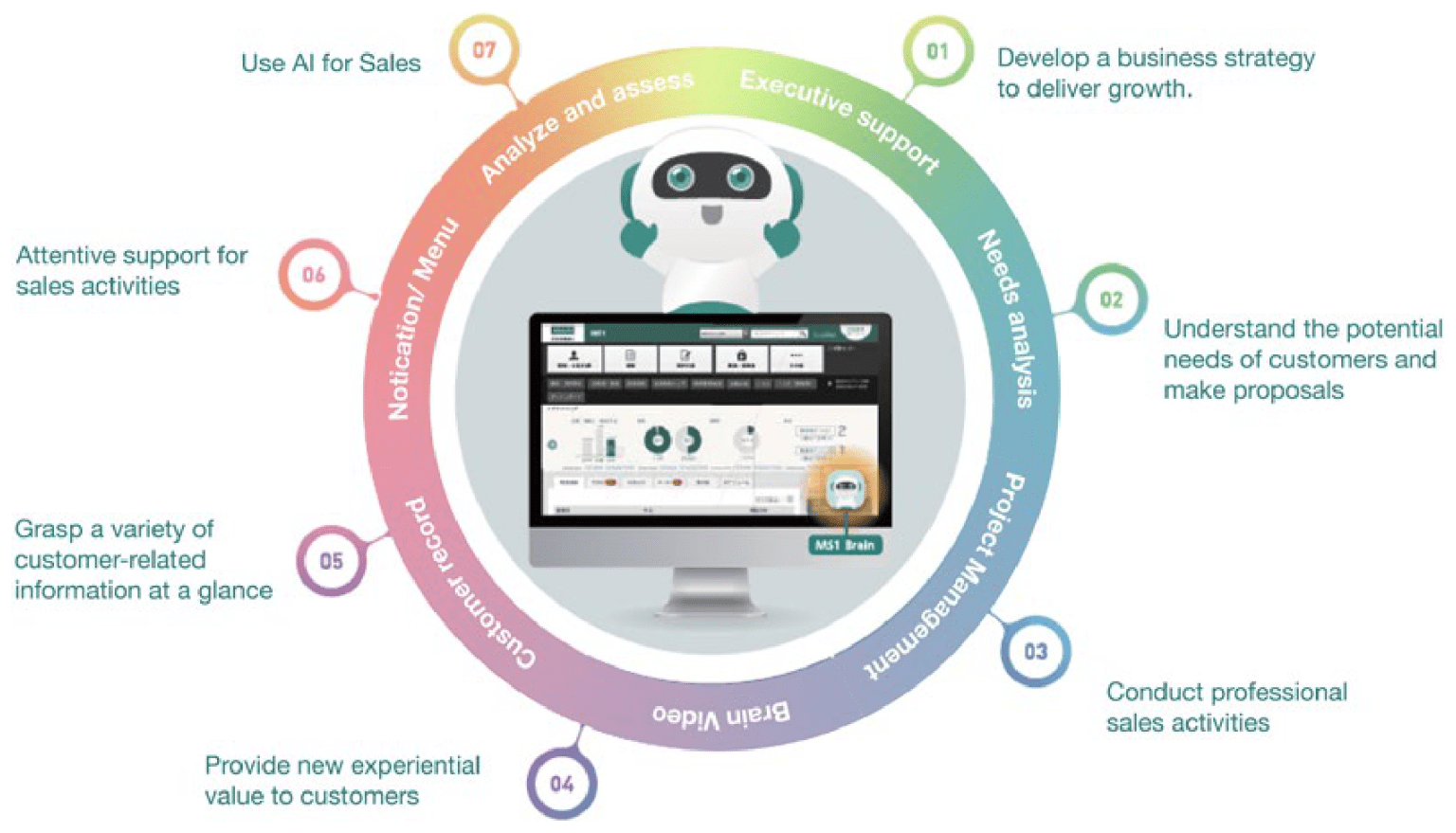

One of their notable initiatives is MS1 Brain, a pioneering AI-based agent sales support system introduced in February 2020. Integrated as an additional function within the existing MS1 business support system, MS1 Brain revolutionizes the way agents interact with customers by leveraging AI to analyze policy and customer information spanning the previous seven years. The system provides personalized recommendations to agents regarding the most suitable products to propose to specific customers at the right time.

Leading the development of MS1 Brain, Mr. Takashi Matsumura sheds light on the project’s background. Recognizing the need to enhance the customer experience through better understanding, MSI sought to move beyond relying solely on the expertise and intuition of their agency sales staff. To deliver a truly personalized experience, a more data-driven and scientific approach was required. This realization led MSI to harness the power of AI for analyzing the vast amount of customer data accumulated over the years.

However, introducing and utilizing AI posed a significant challenge in terms of human resources. While MSI had a substantial number of actuaries responsible for insurance product design and risk analysis, the availability of data scientists to support marketing and sales activities was limited. Consequently, the company relied heavily on external talent, highlighting the pressing need to address this resource gap.