dotData’s AI reveals risk signals that help lenders cut losses by up to 2%, improve models

by 15–20%, and scale productivity 5×—with no added headcount.

AI in Credit Unions

Solutions for

Request a Demo

Solutions for

Credit Unions

Boost member quality of service by discovering risks

missed by your current solutions.

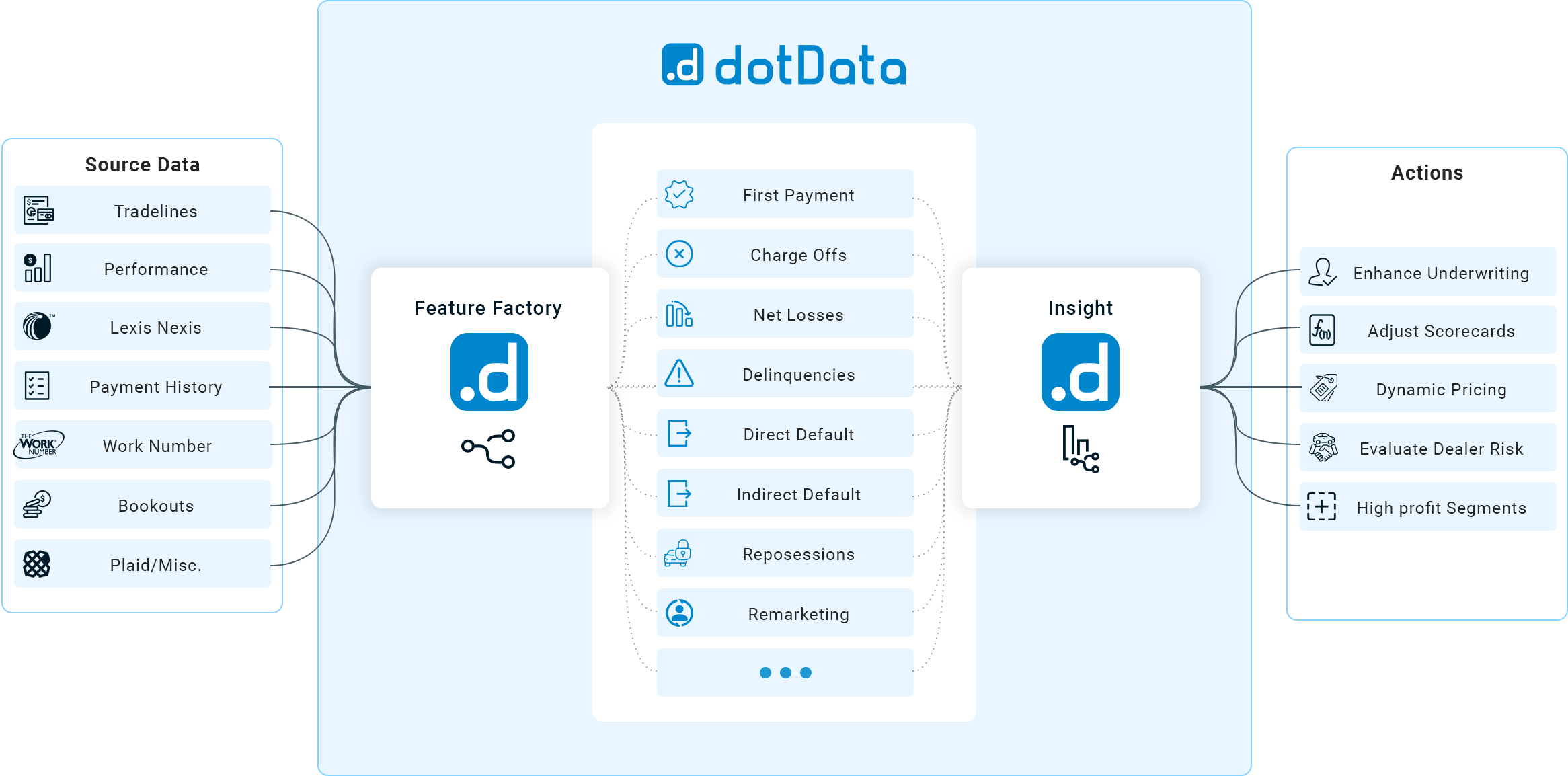

How dotData Works

How dotData Delivers Value

Discover Key Drivers Impacting Your Business

Intuitive, powerful, fast – identify critical drivers from your credit union data:

- Direct and Indirect Lending, Originations, and Servicing

- Delinquencies, Remarketing, and Dealership-specific Concerns

- Enhance Underwriting Guidelines and Evaluate Underwriter Performance

- Improve Rate Cards Based on Data-Driven Insights

What Our Customers Say

Exeter Finance

The biggest problem is that, when doing it manually, it’s just a repetitive, trial-and-error process that takes time. dotData solves a problem I’ve been trying to solve for 20 years.

sticky.io

I was spending 95% of my time wrangling data…now I can offload most of that work and just focus on delivering viable patterns and insights.

News

Press Release

dotData Enterprise 4.0 Launches with Fully-Redesigned Predictive Analytics UX and Feature Factory Innovations

Press Release

dotData Announces dotData Feature Factory 1.3 with Enhanced AI-Powered Feature Discovery and Expanded LLM Support

Press Release

dotData Announces dotData Insight 1.3 with AI-Data Cleansing and AI-Driven Column Enrichment

Press Release

dotData Announces dotData Insight 1.2 with Advanced Text Signal Discovery and Enhanced Data Transformation

Press Release

dotData Announces dotData Ops 1.4 with Advanced Python Ecosystem Integration

Request a Demo

We offer support tailored to your needs, whether you want to see a demo or learn more about use cases.

Learn about Data Insights

Agentic AI in Data Analytics – Explore Amazon Q in Amazon QuickSight

Masato Asahara, Ph.D.